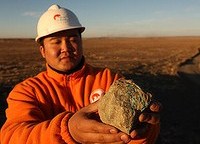

TURQUOISE HILL JUMPS 11% AFTER ALLAYING OYU TOLGOI FEARS

Turquoise Hill Resources (TSX:TRQ), 66%-owner of Oyu Tolgoi, raced ahead more than 11% on Friday after soothing investor fears about negotiations with the Mongolian government over the future of the massive copper-gold mine.

Stock in Turquoise Hill, which is controlled by Rio Tinto (LON:ASX), was changing hands at $7.05, up 11.1% by lunchtime in heavy volumes after the Vancouver-based company characterized discussions over project development and costs, operating budget, project financing, management fees and governance as “productive”.

Turquoise Hill, worth $6.9 billion in Toronto is still trading down more than 60% over the past year and is down from a peak above $28 a share hit in March 2011.

Negotiations over Oyu Tolgoi, set to go into commercial production by end of June, will continue through March according to the press release.

A 2009 deal gave Mongolia 34% of Oyu Tolgoi, but but wrangling over ownership of the project which is set to transform the economy of Mongolia has only intensified since a new government laden with resource nationalists took power last year.

Mongolia has accused Rio of working fast and loose with financing for the project – an underground mine to compliment the open pit could put the final bill at $13 billion by some estimates.

In October 2011 there was also a standoff over ownership of Oyu Tolgoi – turquoise hill in the local language – when the then Ivanhoe Mines plunged on news that the Mongolian government wants to rework the deal to gain a 51% stake.

At the time Rio and Ivanhoe took a tough stance and after some desperate negotiations Mongolia backed off, but the stock has never really recovered since then.

Frik Els | March 1, 2013

Stock in Turquoise Hill, which is controlled by Rio Tinto (LON:ASX), was changing hands at $7.05, up 11.1% by lunchtime in heavy volumes after the Vancouver-based company characterized discussions over project development and costs, operating budget, project financing, management fees and governance as “productive”.

Turquoise Hill, worth $6.9 billion in Toronto is still trading down more than 60% over the past year and is down from a peak above $28 a share hit in March 2011.

Negotiations over Oyu Tolgoi, set to go into commercial production by end of June, will continue through March according to the press release.

A 2009 deal gave Mongolia 34% of Oyu Tolgoi, but but wrangling over ownership of the project which is set to transform the economy of Mongolia has only intensified since a new government laden with resource nationalists took power last year.

Mongolia has accused Rio of working fast and loose with financing for the project – an underground mine to compliment the open pit could put the final bill at $13 billion by some estimates.

In October 2011 there was also a standoff over ownership of Oyu Tolgoi – turquoise hill in the local language – when the then Ivanhoe Mines plunged on news that the Mongolian government wants to rework the deal to gain a 51% stake.

At the time Rio and Ivanhoe took a tough stance and after some desperate negotiations Mongolia backed off, but the stock has never really recovered since then.

Frik Els | March 1, 2013

Comments

Post a Comment