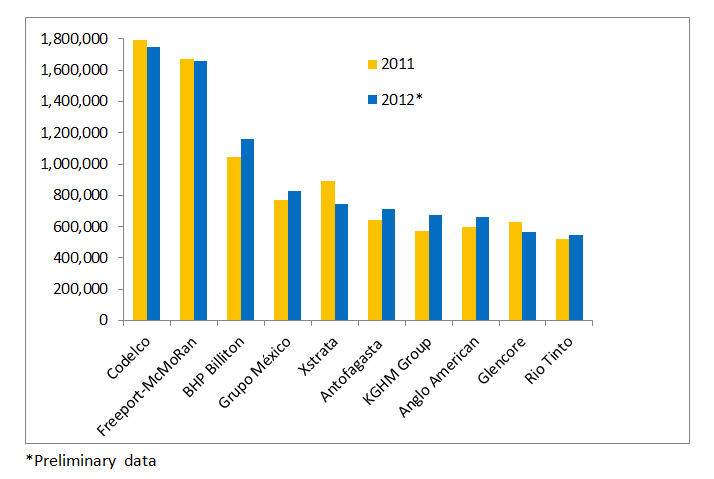

TOP 10 COPPER COMPANIES IN 2012

Last year saw some tough competition amongst the world’s biggest copper miners.

Preliminary estimated volume of corporate attributable copper production by the top 10 companies rose roughly 2%, from 9.14 million tonnes in 2011 to 9.31 million tonnes for the 2012 calendar year.

Six out of 10 companies increased their copper output while four of them declined.

Chilean state-owned miner Codelco holds first place worldwide in terms of corporate copper output with preliminary estimates of 1,750 thousand tonnes (kt) of copper produced in 2012, including Codelco’s stake in Minera el Abra and Anglo American Sur S.A, an approximate 3% decline on 2011 (1,796 kt).

This drop was mainly caused by lower ore grades treated at Codelco’s plants, with ore grades down by 19% at Chuquicamata. However, the company’s full-year production figures are expected to be very close to the 2012 budget.

Headquartered in Phoenix, Ariz., Freeport-McMoRan Copper & Gold Inc. (NYSE: FCX) ranks second in global competition. It produced about 1,662 kt of copper in 2012, or about 1% lower compared to 2011 (1,674 kt), because of production decline at Grasberg mine, as well as Cerro Verde and the Candelaria/Ojos del Salado mines.

Ranking third, Anglo-Australian BHP Billiton (ASX:BHP, LSE:BLT) increased its copper output by 11%, from 1,047 kt in 2011 to 1,163 kt in 2012. This double-digit growth rate is a stunning increase for copper production at Escondida — a result of the transition to a higher grade ore feed and the successful completion of large-scale maintenance programs that have increased concentrator throughput. Record production at Antamina also contributed to the total growth of BHP’s copper output.

Holding fourth place, Mexican Grupo México (PINK:GMBXF) through its subsidiaries, Southern Copper Corporation (NYSE:SCCO) and the American Smelting and Refining Company (ASARCO), increased its consolidated copper production by 7%, from 773 kt in 2011 to 826 kt in 2012. This increase is the result of greater production at the Buenavista, Cuajone, and Ray mines, by 16%, 13%, and 9%, respectively, driven by better recoveries and improved ore grades.

Fifth in the list, Anglo-Swiss Xstrata plc (LSE: XTA, SIX: XTAN) had total mined copper production of 747 kt which was 16% lower compared to 2011. Xstrata Copper transitioned from older, end-of-life mines to new mines and expansions plus addressed production challenges at the Collahuasi joint venture. Copper in concentrate production rose at Antamina and Alumbrera mines but fell at Collahuasi, Altonorte, Tintaya, Ernest Henry and Mount Isa.

Copper production for sixth-place Chilean-based Antofagasta plc (LSE:ANTO) in 2012 was 710 kt, an 11% increase compared with 641 kt in 2011, mainly due to higher production at Esperanza and Los Pelambres mines with increased throughput levels.

Poland-based KGHM Polska Miedź Group (WSE:KGH) jumped up from ninth to seventh place in global copper competition with a reported 18% growth for 2012 production.

Eighth-placed British Anglo American plc (LSE: AAL) reported total copper production, including the company’s share in the Collahuasi joint venture, of 660 kt, which was 10% higher than in 2011. This was mainly due to the increased contribution from the Los Bronces expansion, offset by lower production at the established Los Bronces operation, and at Collahuasi and Mantos Blancos.

In ninth place, Anglo–Swiss Glencore International plc (LSE:GLEN) saw total copper production, including the company’s own feed plus third-party feed, amount to 566 kt or 10% lower than in 2011. Looking solely at Glencore’s copper production from its own feed, its production increased by 4% in 2012, to 377 kt. Copper production rose at the Mutanda and Katanga mines while it fell at the Mopani, Pasar and Cobar mines.

British-Australian Rio Tinto (LSE:RIO, ASX:RIO) sits in tenth place and increased its attributable mined copper output by 6%, from 520 kt in 2011 to 549 kt in 2012. Production increased at Escondida and Northparkes, but declined at Kennecott Utah Copper. The Grasberg mine put out zero tonnes of copper last year.

Note: For corporate attributable copper production, figures and facts used are from actual official data or companies’ expectations for the 2012 calendar year.

Preliminary estimated volume of corporate attributable copper production by the top 10 companies rose roughly 2%, from 9.14 million tonnes in 2011 to 9.31 million tonnes for the 2012 calendar year.

Six out of 10 companies increased their copper output while four of them declined.

Chilean state-owned miner Codelco holds first place worldwide in terms of corporate copper output with preliminary estimates of 1,750 thousand tonnes (kt) of copper produced in 2012, including Codelco’s stake in Minera el Abra and Anglo American Sur S.A, an approximate 3% decline on 2011 (1,796 kt).

This drop was mainly caused by lower ore grades treated at Codelco’s plants, with ore grades down by 19% at Chuquicamata. However, the company’s full-year production figures are expected to be very close to the 2012 budget.

Headquartered in Phoenix, Ariz., Freeport-McMoRan Copper & Gold Inc. (NYSE: FCX) ranks second in global competition. It produced about 1,662 kt of copper in 2012, or about 1% lower compared to 2011 (1,674 kt), because of production decline at Grasberg mine, as well as Cerro Verde and the Candelaria/Ojos del Salado mines.

Ranking third, Anglo-Australian BHP Billiton (ASX:BHP, LSE:BLT) increased its copper output by 11%, from 1,047 kt in 2011 to 1,163 kt in 2012. This double-digit growth rate is a stunning increase for copper production at Escondida — a result of the transition to a higher grade ore feed and the successful completion of large-scale maintenance programs that have increased concentrator throughput. Record production at Antamina also contributed to the total growth of BHP’s copper output.

Holding fourth place, Mexican Grupo México (PINK:GMBXF) through its subsidiaries, Southern Copper Corporation (NYSE:SCCO) and the American Smelting and Refining Company (ASARCO), increased its consolidated copper production by 7%, from 773 kt in 2011 to 826 kt in 2012. This increase is the result of greater production at the Buenavista, Cuajone, and Ray mines, by 16%, 13%, and 9%, respectively, driven by better recoveries and improved ore grades.

Fifth in the list, Anglo-Swiss Xstrata plc (LSE: XTA, SIX: XTAN) had total mined copper production of 747 kt which was 16% lower compared to 2011. Xstrata Copper transitioned from older, end-of-life mines to new mines and expansions plus addressed production challenges at the Collahuasi joint venture. Copper in concentrate production rose at Antamina and Alumbrera mines but fell at Collahuasi, Altonorte, Tintaya, Ernest Henry and Mount Isa.

Copper production for sixth-place Chilean-based Antofagasta plc (LSE:ANTO) in 2012 was 710 kt, an 11% increase compared with 641 kt in 2011, mainly due to higher production at Esperanza and Los Pelambres mines with increased throughput levels.

Poland-based KGHM Polska Miedź Group (WSE:KGH) jumped up from ninth to seventh place in global copper competition with a reported 18% growth for 2012 production.

Eighth-placed British Anglo American plc (LSE: AAL) reported total copper production, including the company’s share in the Collahuasi joint venture, of 660 kt, which was 10% higher than in 2011. This was mainly due to the increased contribution from the Los Bronces expansion, offset by lower production at the established Los Bronces operation, and at Collahuasi and Mantos Blancos.

In ninth place, Anglo–Swiss Glencore International plc (LSE:GLEN) saw total copper production, including the company’s own feed plus third-party feed, amount to 566 kt or 10% lower than in 2011. Looking solely at Glencore’s copper production from its own feed, its production increased by 4% in 2012, to 377 kt. Copper production rose at the Mutanda and Katanga mines while it fell at the Mopani, Pasar and Cobar mines.

British-Australian Rio Tinto (LSE:RIO, ASX:RIO) sits in tenth place and increased its attributable mined copper output by 6%, from 520 kt in 2011 to 549 kt in 2012. Production increased at Escondida and Northparkes, but declined at Kennecott Utah Copper. The Grasberg mine put out zero tonnes of copper last year.

Note: For corporate attributable copper production, figures and facts used are from actual official data or companies’ expectations for the 2012 calendar year.

Comments

Post a Comment